Standard Nine: Financial Resources

Description

One of the three overarching goals of Wesleyan 2020 is to “work within a sustainable economic model while maintaining core values.” Those values include commitment to diversity (including economic diversity in the student body); commitment to employing highly qualified faculty and staff; commitment to supporting research; and commitment to supporting effective pedagogy and co-curricular programming. These commitments are becoming more and more expensive to sustain, and Wesleyan’s efforts to establish a sustainable financial structure have featured important changes in both asset management and long-term budget planning.

Wesleyan’s bylaws stipulate that the Finance Committee of the Board is responsible for the Board’s activities relating to the University’s capital and operating budgets, as well as the establishment and monitoring of a long-range financial plan. For a description of Wesleyan’s budget planning process, please see Standard 2, Planning and Evaluation.

The Audit Committee of the Board has responsibilities related to monitoring the integrity of the University’s financial statements, compliance with legal and regulatory requirements, and oversight of risk assessment practices and adequacy of internal controls. The committee also reviews the University’s tax returns. The audit committee meets a minimum of two times a year. Every year the audit committee retains a firm of certified public accountants (KPMG) to examine the accounts of the University and to consult with the committee. In addition to the annual audited financial statements, the University retains KPMG to opine on the use of state and federal funds (principally financial aid and faculty grants) and debt compliance issues. In addition, the University retains a regional auditing firm to audit its retirement plan.

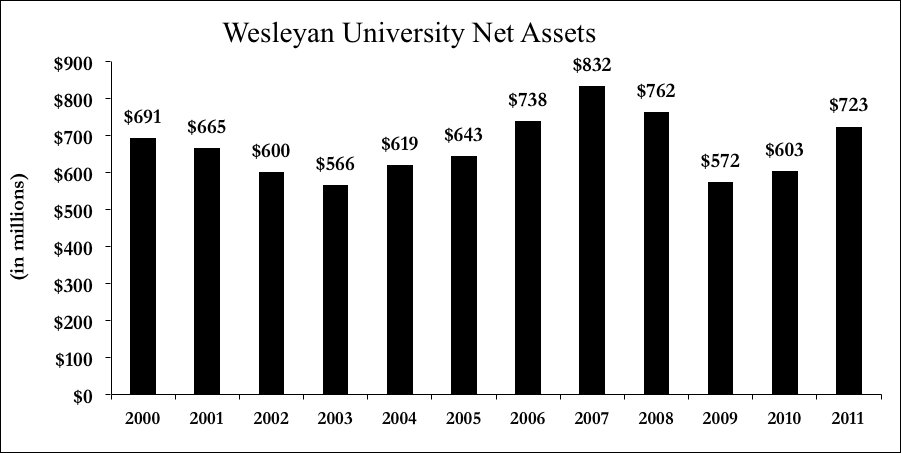

During the fiscal year ended June 30, 2011, Wesleyan University’s net assets increased by $120 million (20%) from $603 million to $723 million. Net assets are still below levels reached before the fiscal crisis, but have largely rebounded because of the increase in the market value of Wesleyan’s endowment.

Wesleyan’s total assets increased to over $1.0 billion in 2011. Liquidity remains strong with over $300 million in assets that can be made available within 30 days. A large cash position provides flexibility to meet commitments during these challenging fiscal times.

To deal with the economic downturn, Wesleyan cut $25 million from its budget and eliminated over 60 staff positions, mostly through a voluntary separation program. Reductions included a salary freeze in 2010 and slower compensation growth. Enrollment will increase by 120 students from 2010 to 2013 (30 more students each year) generating an additional $5 million in student charges revenue net of financial aid. The process was aided by discussions with the newly created Budget Priorities Committee made up of faculty, staff, and students and the Ad-Hoc Faculty Working Group.

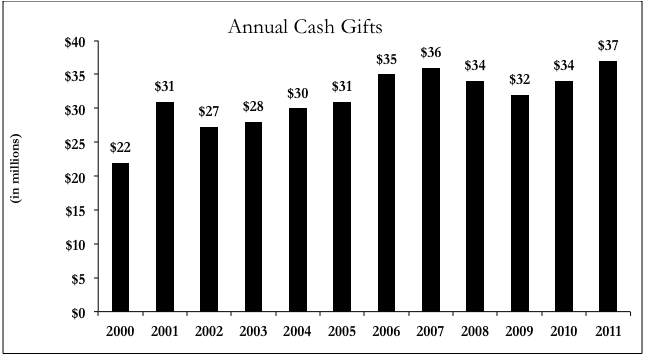

In FY 2010/11, alumni, parents, and friends gave over $37 million on a cash basis to Wesleyan, the largest amount of cash received in any year in history. This $3 million (8.8%) increase from the prior year, with 51% of the alumni donating funds, reflected a strong financial commitment to Wesleyan from our donors, even during challenging economic times.

Appraisal

Managing Debt

In May 2010, Wesleyan reduced risk related to the debt portfolio, its largest liability. At that time, 100% of debt was in the form of weekly or daily floating variable rate demand bonds. Wesleyan refinanced all of this debt into 90% fixed ($186 million) and 10% variable ($20 million) bonds. In addition, all interest rate swaps were terminated. These changes reduced Wesleyan’s risk from bondholders, counterparties, and banks. The refinancing also created budget certainty at an attractive cost (5.12% all in cost). Wesleyan maintains its strong Moody’s AA3 and Standard & Poor’s AA ratings.

Endowment Management

The endowment market value of $610 million as of April 2012 has rebounded from a low of $442 million in March 2009. In 2011, investment performance was 21% with a 10-year annualized performance of 5.8%.

Three changes were made to promote endowment preservation and growth. First, a new Chief Investment Officer started in August 2010 and is in the process of reviewing all Wesleyan investments and planning a new strategy for a staff-driven investment process. In addition, the Board of Trustees established a new standing committee, the Investment Committee, to oversee the office, as well as recommend and implement investment policy.

Second, since 2009, the endowment draw has been 5.5% of the trailing 12-quarter average market value of the endowment ending December 31. This spending level is within the policy established by the Board in 1981. This is a decrease from 7.4% in 2006.

By making strategic budget cuts, Wesleyan was able to reduce the Wesleyan Fund (annual unrestricted giving) goal from a high of $17.6 million in 2008 to $10.2 million in 2012, with gradual increases scheduled thereafter. Alumni have responded favorably to this shift in emphasis toward endowment, and in 2010 for the first time in recent memory Wesleyan raised more dollars for endowment than for the annual fund.

In 2012 Wesleyan’s Board adopted a new endowment spending policy incorporating the principles of minimizing disruptions in annual disbursements to the operating budget and maintaining the inflation-adjusted value of gifts (intergenerational parity) by setting payouts plus inflation less than expected investment return. Payouts will be based on a weighting of 70% determined by the prior year distribution, increased by inflation, and 30% determined from 4.5% of endowment market value from June 30 of the prior fiscal year. The policy provides a “yellow light” if the draw should rise above 6% as a consequence of significant declines in equity markets; the administration and the Board would then reconsider the draw.

Financial Aid and Affordability

In the spring of 2012 President Roth introduced an initiative designed to make Wesleyan more affordable in a sustainable way, with three principal elements. The first is to establish a “discount rate” that is as generous as possible, but that is also one Wesleyan can afford. Just under a third of the University’s tuition charges will go to financial aid.This is approximately the percentage of the budget devoted to aid from 2000-2008.

Setting financial aid to a discount rate is a significant change in practice for Wesleyan. From 1997 to 2013 (projected), the discount rate has risen from 22% to 37%—an unsustainable rate of increase.

Wesleyan remains committed to meeting the full financial need of admitted students without increasing required student indebtedness. The Admission Office will have to consider the capacity of some students to pay, as is done now with transfer and international students. Current estimates are that about 90% of each class (depending on the level of need) will continue to be admitted on a need-blind basis. Wesleyan expects to build a more generous and sustainable financial aid program over time by raising more funds for the endowment.

The second component of the affordability effort will be linking tuition increases to the rate of inflation. Restraining tuition increases will require the University to maintain its search for efficiencies while also investing in educational innovation across the curriculum.

The third component is to emphasize a three-year option for those families seeking a Wesleyan experience in a more economical form. Wesleyan will help those students who choose to graduate in six semesters get the most out of their time on campus. For those students who are prepared to develop their majors a little sooner, shorten their vacations by participating in the intensive Summer Sessions, and take advantage of the wealth of opportunities on campus, this more economical BA might be of genuine interest. Allowing for some summer expenses, families would still save about 20% from the total bill for an undergraduate degree.

Projection

Endowment draw will be further reduced from 5.5% to 5.0% of the trailing 12-quarter average market value of the endowment ending December 31 over the next five years. The 2012-13 operating budget will include a 5.3% endowment spending rate with the goal of reaching 5.0% in 2015-16. In addition, the Board will review the current spending policy and make recommendations for any changes by May 2012 with implementation starting in 2013-14.

The University is exploring ways of increasing revenue other than general tuition hikes to support both educational quality and fair access. To generate new revenue sources Wesleyan is focusing on its strength: providing quality educational experiences. An undergraduate summer session pilot is underway. The pilot has been approved for an additional five years ending in 2016. Master’s level programs are also under development and review.

The quiet phase of the new campaign began July 1 2007, with some pre-campaign gifts grandfathered. As of May, 2011, $237 million in gifts and pledges has been received toward a working goal of $400 million. Of this amount, $141 million in cash has already been received. There are sub-goals of $225 million for endowment; $115 million for the Wesleyan Fund; $20 million for facilities; and $40 million for current other restricted. The launch date of the public phase is dependent on the fundraising pace, but is planned for spring 2013.

Faculty salaries for assistant and associate professors should be more competitive and be at least at the median of the peers. Based on 2011 faculty compensation data, assistant faculty and associate faculty lag behind the peers by $3,500 and $3,400 respectively. The University will implement this goal over the next three fiscal years at a cost of approximately $200,000 a year. A projected total of $600,000 will be added to the faculty compensation budget by 2014/15 for this purpose.

To date, Wesleyan has adopted measures to improve the reliability of its endowment returns and to increase the proportion of annual gifts going into the endowment while reducing the draw on the endowment to cover current operating expenses. These changes have yielded significant results, which have nonetheless been offset by adverse financial trends relating to the state of the economy. To move closer to its goal of economic sustainability, the University will be reviewing all its policies regarding revenue as well as its strategies for managing costs, endowment draw, and ongoing debt burdens.

Institutional Effectiveness

Since its last reaccreditation, Wesleyan has implemented a new financial reporting system with much tighter controls and electronic approvals of expenditures. Wesleyan also has created a Budget Working Group that reviews each request for new or replacement positions before the hiring process can move forward. Staffing levels are benchmarked through the COFHE staffing survey. Wesleyan’s annual budgeting process and long-range planning, overseen by the Board and its Finance Committee, and the annual audit process, overseen by the Board and its Audit Committee, assure appropriate evaluation of its fiscal condition and financial management.